888-SOLAR-72

Top-Notch Service and Premium Solar Products

How The Solar Tax Credit Works

How Solar Tax Credits Work

The solar tax credit is a federal tax incentive that can help individuals and businesses to save money on the installation of solar energy systems. Continue reading to discover additional information on how the solar tax credit works and how it can help to make solar energy more accessible and affordable for everyone.

What is the Solar Tax Credit?

The solar tax credit, also known as the Investment Tax Credit (ITC), is a federal tax incentive that was introduced in 2006 to encourage the adoption of solar energy systems in the United States. The credit is available to both residential and commercial customers who purchase and install a solar energy system, and it is designed to reduce the cost of the installation by a percentage of the total cost.

Before the passage of the Inflation Reduction Act in August of 2022, the solar tax credit was set at 26% for installations in 2022 and was expected to decrease to 22% in 2023 and disappear completely in 2024. Now, with the enactment of the Inflation Reduction Act, the tax credit has increased to 30% (possibly 40% if your materials are made in the United States). This includes the total cost of the solar installation with equipment and labor. This credit applies to both new installations and upgrades to existing systems, and there is no cap on the total amount of credit that can be claimed.

The solar tax credit has been extended and is now set to expire in 2033 and will begin to reduce starting in 2033. Although it's not not anticipated to decrease for another decade, it is recommended to install solar as soon as possible for two main reasons. First, the earlier you install, the sooner you can enjoy the benefits of your investment. Second, net metering regulations are subject to change over time, so it is best to take advantage of the current net metering policies.

How Does the Solar Tax Credit Work?

The solar tax credit is a dollar-for-dollar reduction in the amount of federal income tax that you owe. For example, if you purchase and install a solar energy system that costs $20,000, you can claim a solar tax credit of $6,000-$8,000 (30-40% of $20,000) on your federal income tax return.

The U.S. Department of Energy states that meeting all the criteria below is necessary to be eligible for the federal solar tax credit:

You must own your home (can be a primary or secondary residence)

You must own your solar system, regardless of whether you have paid for it upfront or are financing its cost

The solar system is new or being used for the first time

The solar tax credit applies to both residential and commercial solar installations, and there is no limit on the number of times that the credit can be claimed. This means that if you install multiple solar energy systems, you can claim the credit for each installation.

The solar tax credit is not a rebate or cash incentive. Instead, it is a tax credit that can be used to offset your federal income tax liability. This means that if you do not owe any federal income tax, you cannot use the solar tax credit to receive a refund.

However,

It is important to note that the solar tax credit only applies to the cost of the solar energy system and not to any other associated costs, such as financing or interest charges. In addition, the solar tax credit cannot be used to offset alternative minimum tax (AMT).

Why is the Solar Tax Credit Important?

The solar tax credit is an important incentive that has helped to make solar energy more accessible and affordable for individuals and businesses. By reducing the cost of solar installations, the tax credit has encouraged more people to invest in renewable energy and reduce their carbon footprint.

In addition to reducing the cost of solar installations, the solar tax credit has also helped to create jobs in the solar industry. According to the Solar Energy Industries Association (SEIA), the solar industry currently employs over 230,000 workers in the United States, and the industry is expected to continue to grow in the coming years.

The solar tax credit has also helped to increase the demand for solar energy systems, which has led to advancements in solar technology and improvements in the efficiency of solar panels. This has made solar energy systems more reliable and efficient, which has further increased their appeal to homeowners and businesses.

How to Claim the Solar Tax Credit

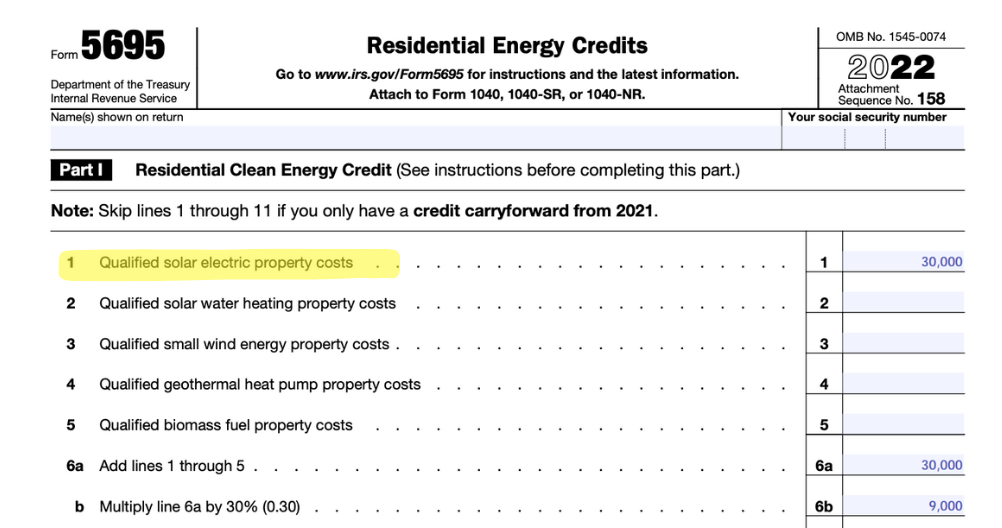

To claim the solar tax credit, you must complete IRS Form 5695 Residential Energy Credits and include it with your federal income tax return. The form will require you to provide information about your solar energy system such as the date of installation, the cost of the system, and the percentage of the system of which is eligible for the solar tax credit. Instructions on how to complete the form can be found by clicking here.

It is important to note that the solar tax credit is a federal incentive and may not be available in all states or jurisdictions. However, many states and local governments offer their own incentives and programs to encourage the adoption of renewable energy, including solar energy systems.

In Kansas, there is currently no state tax credit available for solar energy systems. However, the state does offer a property tax exemption for residential solar energy systems, which can help to reduce the overall cost of the installation. In addition, many utilities in Kansas offer rebates and other incentives to encourage the adoption of renewable energy.

It is important to research the incentives and programs available in your state and local jurisdiction to determine how you can save money on the installation of a solar energy system.

Ready to Take Advantage of the Solar Tax Credit?

If you're interested in exploring how you can take advantage of the solar tax credit and want to learn more about the benefits of solar energy for your home or business, we're here to help. Our team of experts is dedicated to providing personalized and professional services to help you make the most of your investment in solar power. Don't hesitate to get in touch with us and request a free quote to see how we can assist you in achieving your renewable energy goals. We look forward to working with you and helping you achieve a brighter, more sustainable future.

What Our Clients Are Saying!

Our feedback is so bright, you gotta wear shades!

2026 The Solar Guys | All Rights Reserved

Business Hours